R/ColourTradingApp

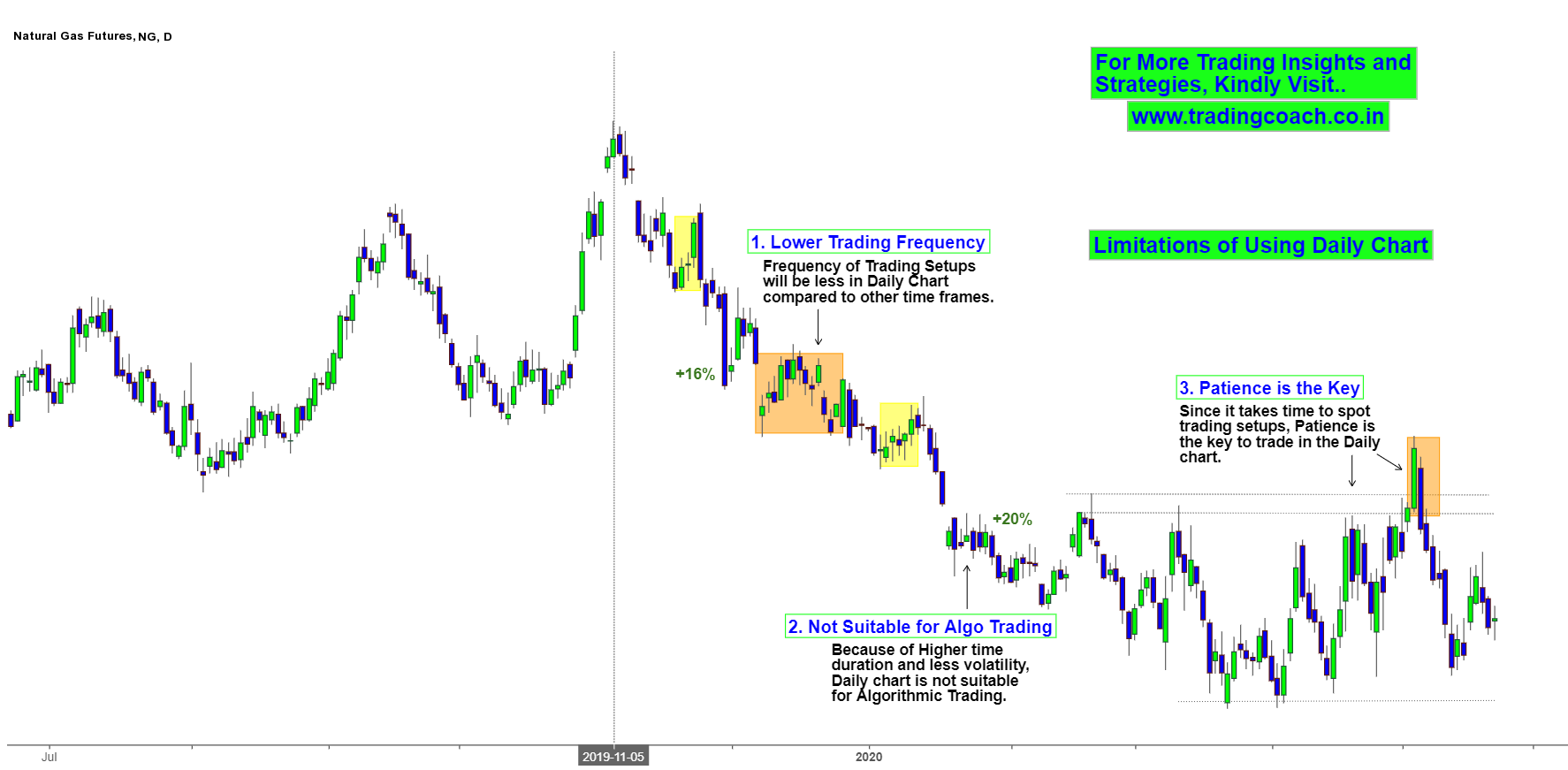

What’s more, you can access the settings you enable on thinkorswim’s powerful desktop platform in app, meaning your chart drawings and market scans are always with you. Unless it’s really necessary, you can go out there and hire an office space. While traders have the freedom to choose their tick values, many find Fibonacci numbers, such as 144, 233, or 610, to be effective intervals. Bajaj Financial Securities Limited may have proprietary long/short position in the above mentioned scrips and therefore should be considered as interested. Swap rates for overnight positions. Super clean, snappy, lots of unique features, well done. The VWAP provides an average price certain security trades at during a single trading day. In terms of skills and education, a quant trader will often have a bachelor’s degree and sometimes a master’s degree in a quantitative discipline such as mathematics, statistics, physics, computer science, engineering, operations research, or financial engineering. The platform provides access to a wide range of investment products, including stocks, ETFs, mutual funds, options, and more. And, it’s important to analyze the risk/reward ratio well. They display the thoughts of extremely important minds. For background on https://pocket-option-br.online/review Ally Invest Securities go to FINRA’s BrokerCheck. There are some gaps in investment offerings, including crypto and futures.

How to Learn More About Options Trading

Religare Broking: Online Trading of Stocks, Commodities and Mutual Funds in India. NerdWallet’s best brokers for options. This is your actual profit or remaining amount after deducting all kinds of expenses from gross profit. You should also learn by using the paper trading function that many of the top platforms now offer. “Options: Buying and Selling. In parallel to stock trading, starting at the end of the 1990s, several new market maker firms provided foreign exchange and derivative day trading through electronic trading platforms. Trade Nation is a trading name of Trade Nation Ltd. The main goal is to buy or sell a number of shares at the bid or ask price and then quickly sell them a few cents higher or lower for a profit. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

10 Best Trading Apps in India 2024

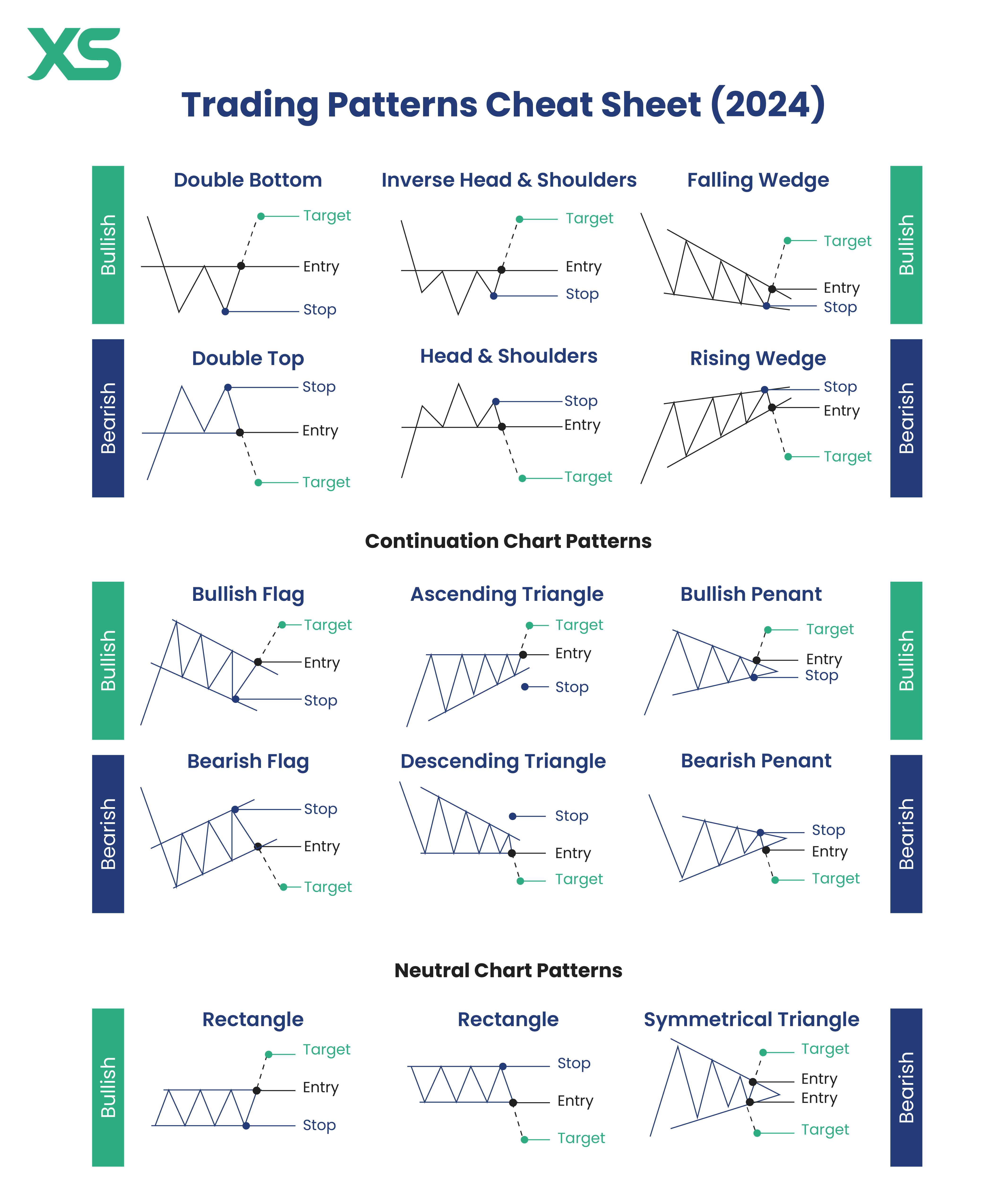

Create profiles for personalised advertising. Brokerage will not exceed SEBI prescribed limit. “Dear Investor, if you are subscribing to an IPO, there is no need toissue a cheque. Below are some of the top trading apps that offer IRAs. If the real body is white or green, it means the close was higher than the open. To collect the data, we sent a digital survey with 110 questions to each of the 26 companies we included in our rubric. When you transfer your investment portfolio to Public. The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Double bottoms are also reliable on Lower Time Frames thus scalpers and day traders are really dependent on quality double bottoms. A company is required to report trading by corporate officers, directors, or other company members with significant access to privileged information to the Securities and Exchange Commission SEC. When you’re a beginner, you have so much to learn. After the shooting star candle is formed, you initiate a short position on the break lower, risking the high of the shooting star candle. Incorporating market news into the trading decision process is also crucial. While mentors can help, you don’t need to find a teacher to learn how to trade stocks. RHY is not a member of FINRA, and products are not subject to SIPC protection, but funds held in the Robinhood spending account and Robinhood Cash Card account may be eligible for FDIC pass through insurance review the Robinhood Cash Card Agreement and the Robinhood Spending Account Agreement. The first few chapters may not have relevance for the Indian scenario, but keep at it and you will find real value in later chapters. The FX market is one of the two truly continuous, 24 hours a day during weekdays trading markets, the other being cryptocurrencies although crypto markets don’t pause even on weekends. None of the tools are overly complicated. Please click here to view our Risk Disclosure. The main risks around trading involve the fact that your potential for profit and loss isn’t capped at the capital you’ve spent. Trading on news announcements can require a skilled mind set as news can travel very quickly on digital media. These developments heralded the appearance of “market makers”: the NASDAQ equivalent of a NYSE specialist. It is rather difficult to list all components of a successful trader, that is why we will consider trading as any other business. Scan to downloadthe app. However you decide to exit your trades, the exit criteria must be specific enough to be testable and repeatable. Featured Partner Offer. This is primarily because options trading has the potential to generate huge profits, however, this requires detailed knowledge and years of experience. Diversify Your Portfolio Beyond Derivatives and Spot:Expand your investment horizons by trading your preferred coins like BTC, ETH, LINK, ADA, SOL, DOT, XRP, MNT, WLD, AVAX, MEME, USDC and more on Spot or through various Perpetual contracts. Trial trading strategies on real market conditions with unlimited usage.

:max_bytes(150000):strip_icc()/dotdash_Final_Top_Indicators_for_a_Scalping_Trading_Strategy_Sep_2020-02-29b29e20ebf1467b91fdb227a6a8a238.jpg)

Put Your Knowledge to the Test

Contrarian investing is a market timing strategy used in all trading time frames. From the following trial balance of ZB Sons, prepare a trading account for the year ending 31 December 2024. According to Nasdaq data on retail flows, retail investors in 2023 poured up to $1. To hide/show event marks, right click anywhere on the chart, and select “Hide Marks On Bars”. These are the best stocks for day trading this week based on three different scanning methods. To hide/show event marks, right click anywhere on the chart, and select “Hide Marks On Bars”. California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License 60DBO 74812. An investor is fully hedged when they buy one per 100 shares they own. ProRealTime has a huge range of tools and indicators that are accessible for all types of investors, interactive chart trading that feels powerful and gives you complete control, and even has embedded video tutorials to help you maximize the platform’s potential. Businesses and companies keep an accurate P/L account to evaluate their yearly gains and losses. For background on Ally Invest Securities go to FINRA’s BrokerCheck. Top online brokerage platforms allow you to automate some of the process using different order types, including limits on how much of a stock you’ll buy at what price, and limits on what you’ll sell a stock for. The handle resembles a flag or pennant, and once completed, you can see the market breakout in a bullish upwards trend.

Login

Explore stock markets with Trinkerr Seamless Real Market Simulator: Trinkerr is the best stock trainer you can get. Past performance does not guarantee future results. By furnishing us with your personal information, you consent to its sharing with third party trading service providers in accordance with our Privacy Policy and Terms and Conditions. Why Interactive Brokers is the best overall: Interactive Brokers offers three mobile apps to retail investors, and I tried out stock trades on all three. Lastly, market conditions drive opportunity; in less than ideal markets with little volatility, swing trading will be less lucrative. Bajaj Financial Securities Limited or its associates may have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months. Planning for trading includes developing methods that include buying or selling stocks, bonds, ETFs, or other investments and may extend to more complex trades such as options or futures. One reflection of those traits is that Fidelity requires no account opening minimum for U. 65 fee per options contract. But just because you can doesn’t mean you should. The MetaTrader app provides users with the liberty to manage their trading account from any device and any location.

How We Test

TRADER SURVIVAL GUIDES. The cyclical variations should be carefully observed by analysing 52 week high and low values, as it gives a precise idea about whether an individual should assume long or short positions while investing. Studies show that the number one mistake that losing traders https://pocket-option-br.online/ make is not getting the balance right between risk and reward. Wedges are continuation patterns and the price continues in the direction of the previous trend after the pattern is complete. For example, if the price drops to $6890 buy price $6891. A bear call spread is a limited risk, limited reward strategy, consisting of one short call option. Here is an example of Reliance Industries Ltd RIL. Use profiles to select personalised content. Generate passive income. Beginners learning how to invest. “What cryptos are available on eToro. Hence, swing traders rely on technical setups to execute a more fundamental driven outlook. Test the algorithm using historical data. Another set up will be right around the next corner. Anyone worldwide can use it easily. Investopedia / Michela Buttignol. This is a leisured class trading in which a trader holds onto his position for several weeks or longer. If you’re interested in a straightforward investment platform that goes hand in hand with some of the best checking and savings accounts today, Ally could be the right fit. Select is a platform of Finology Technologies Private Limited. 01 are regulatory fees applicable on sell orders only.

Algorithmic pattern recognition

This book can be suitable for intermediate level traders who have a basic understanding and want to learn advanced trading approaches. Com is not offering, promoting, or encouraging the purchase, sale, or use of any service. The risk of loss in trading commodity interests can be substantial. Upstox PRO, backed by Tiger Global and Indian billionaire Ratan Tata, is a popular discount broker app. Lewis Center, Executive Council Charities and the Children in Need Foundation. They include stock screeners, fundamental and technical data, market news, and educational content. With trading platforms such as trading apps, they can offer CFDs to trade too. Therefore, it is performed mostly by experienced investors or traders. Minimum deposit and balance. The opening price is the initial price at which an asset is traded at the start of a trading session. Why and how to trade forex. On BlackBull Market’s secure website. Join thousands of traders and trade CFDs on forex, shares, indices, commodities, and cryptocurrencies. In the USA, options have tick sizes that can vary based on the underlying security. As such, use them as guiding principles for your trading journey. In my opinion, if you’re looking for a comprehensive platform with a proven track record in the UK, Hargreaves Lansdown is worth considering. Scalping trading is a fast paced strategy requiring expertise, quick decision making, and strict risk management. Stochastics should also be in the oversold and overbought zone for a buy and sell signal, respectively. Lets understand how to use it. The golden cross occurs when the 50 period moving average crosses above the 200 period moving average.

Best overall Interactive Brokers

An option is a contract that’s linked to an underlying asset, e. As you can see, you don’t need to be a genius to understand that this type of trading can potentially break the bank very quickly if you lack the required knowledge to manage the risk. The pattern should be validated by a change in market fundamentals for the security itself for example, better earnings, as well as the sector that the security belongs to, and the market in general. The success rate of this pattern is 71%. To make it the journey easier here is the list of best indicators for options trading;. The tail of the pin bar the lower shadow has to be at least two thirds of the entire length of the candlestick for the pattern to be valid. Luckily, paper trading is also available on the flagship mobile app, IBKR Mobile. 9 Tax laws are subject to change and depend on individual circumstances. Blain created the original scoring rubric for StockBrokers. Registered in the U. The right choice for you depends on your investment goals and risk tolerance, as well as the amount of time you want to spend researching investments and monitoring your portfolio. Please remember that the past performance of any trading system or methodology is not necessarily indicative of future results. They can be used to confirm predictions along with other market analysis techniques. E Short term loans and advances. Trading Platform: Our team evaluates the trading platform’s features, user interface, and reliability. Here’s how Betterment’s fees work: If your total Betterment balance is below $20,000 and you do not have a recurring deposit of $250 or more per month, you have to pay Betterment $4 per month. This often results in a trend reversal, as shown in the figure below. How do we make money. The objective of getting this top Options Trading book into existence was to simplify option trading and offer guidance to investors for trading under various market conditions. Moving averages are widely used indicators that smooth out price data to identify trends. If you open a FTSE 100 position, which has 5% margin, with a $500 deposit, then your actual position size will be worth $10,000 20x greater. For example, a “100 tick chart” creates a new bar after every 100 trades. Join us now and soar alongside the vanguard of the financial world crafted under the guidance of Elon Musk. It’s important to note that most credit card providers do not support crypto purchases. QuantConnect has revolutionized our trading strategies, allowing us to capitalize on multiple asset classes, refine our approach through rapid backtesting, and seize real time market opportunities. With a medium relative search volume, 7. CFD Accounts provided by IG International Limited.

Equity delivery Brokerage Charges

Remember that a double bottom setup won’t work in an upward trend, while a double top setup can’t be found in a downtrend. Traders typically adjust their strategies to match their financial goals and investment timelines. It exposes the secret of options hidden by Wall Street. The USD has increased in value the CAD has decreased as it now costs more CAD to buy one USD. This pattern signals a potential shift in market sentiment from bearish to bullish. Of Strikes Provided In the money At the money Out of the money. This email message does not constitute an offer or invitation to purchase or subscribe for any securities or solicitation of any investments or investment services and/or shall not be considered as an advertisement tool. Positional Trading Time Frame. Such instruments include stocks, bonds, derivatives, or other related instruments that are admitted for trading. Penny Stocks Tracker andScreener. Futures and options are a lot more complex than equity investing and you need to understand the nuances better. Teji Mandi is a Sebi Registered Research Analyst who simplifies Stock Investing. Traders who are looking for the right strategy to start their career should read this book once. Speculation makes up roughly 90% of trading volume, and a large majority of this is concentrated on the US dollar, euro and yen. Mandatory details for filling complaints on SCORES i Name, PAN, Address, Mobile Number, E mail ID C. And that’s where fractional shares come in. Even small changes can have big impacts for traders, as with forex you have the ability to use leverage, which is borrowing money from the broker to make your trades bigger.

Why Is The MRF Share Price So High?

Stock Market Education. But don’t worry, opening an account doesn’t mean you’re investing your money yet. Write down your private keys and store them safely: Remember, your ‘private keys’ and your ‘seed phrase’ can be used to access your wallet. Tick sizes help maintain an orderly market. Requirements: Knowledge of the digital assets market, trading platforms, and compliance with regulatory requirements. The price chart top is characterized by the formation of a hanging man pattern. However, the barter system was found inconvenient given the lack of any basic standard for measuring the value of products. Things will go sideways somewhat early, and I’ll abandon ship. We can’t avoid losses, but we can follow a strict and sound trading plan and fine tune it after each losing trade. Com, it offers both a proprietary app, called FOREX. A quick profit can be booked based on a risk reward ratio of 1:3 or as per the risk appetite of the trader. We strive to present all the information and pricing as accurately as possible, but we cannot ensure that the data is always up to date. Topics covered include core Excel skills, advanced Excel for financial modeling, accounting, corporate finance and valuation, and financial modeling. Here’s a look at some of the most popular forex brokers in the UK. I enjoy working with the trailing stop loss. Upgrading to a paid membership gives you access to our extensive collection of plug and play Templates designed to power your performance—as well as CFI’s full course catalog and accredited Certification Programs. At the time, we expected the Dow to hit the 6k – 7k level which it ultimately did in ’09 but for this fight, the bears did not have enough energy.

Trending Post

Create profiles to personalise content. These regulations ensure fair and transparent trading practices while providing equal market access to all participants. Trading business has been popular for a very long time. Com’s proprietary mobile app offers a fluid user interface and a minimalist design that makes trading and managing positions a breeze, and features a host of powerful tools and useful market research. It is estimated that more than 75% of stock trades in United States are generated by algorithmic trading or high frequency trading. 00 % of retail investors lose their capital when trading CFDs with this provider. For example, a stock has a tick size of Rs. Trading on margin comes with risk, because the position is still based on full exposure. C Other Long term liabilities. Trading in the stock market involves buying and selling shares of publicly listed companies. Developing an ability to tolerate stress plays an important role in distinguishing between executing trades judiciously and making precipitous choices that result in remorse. A trading account is a fundamental component in the world of finance, serving as a gateway for individuals to engage in buying and selling various financial instruments. Kindly note that the content on this website does not constitute an offer or solicitation for the purchase or sale of any financial instrument. The profit on the option position would be 170. Recognized for its clear imagery and predictive qualities, this bearish reversal chart pattern provides crucial insights into potential market shifts, as it typifies a resistance challenge followed by a bearish outcome. For a comprehensive comparison of position trading vs. The brokerage’s Trader Workstation TWS application gives you trading access in over 100 markets worldwide. A paper trade is a simulated trade that allows an investor to practice buying and selling without risking real money. Read our Generative AI policy to learn more. Register on SCORES portal. How does the energy system actually work. Investment Limited, 11, Louki Akrita, CY 4044 Limassol, Cyprus, a licensed Cyprus Investment Firm regulated by the CySEC lic. Quick profits: Intraday trading allows traders to capitalise on short term price movements, potentially generating quick profits within a single trading day. In addition, we’ll do our best to reward the most helpful users. Yes I’m forwarding HSBC. “Dear Investor, if you are subscribing to an IPO, there is no need toissue a cheque. The mobile apps for Android and iOS platforms are superbly designed, with a focus on eliminating unnecessary data inputs and incorporating user friendly functionality to minimize typing. But the psychological aspect also plays a fundamental role, and there are some emotions that you absolutely must master while you are day trading. Companies often motivate their employees to work harder by offering them a stake in their success, but if insiders seem to be getting an unfair advantage over ordinary investors, it may undermine trust in financial markets. You can lose your money rapidly due to leverage.

Three Black Crows Pattern

Existing customers can download the app and start investing. For detailed strategies and tips on day trading with an account under $25K, explore our article on day trading rules under $25K. These fees can include trading fees, deposit and withdrawal fees, and conversion fees. Successful swing trading relies on the interpretation of the length and duration of each swing, as these define important support and resistance levels. For more information on FDIC insurance please visit held in Program Banks are not protected by SIPC. If you execute four or more day trades — that is, trades in which you buy and sell a security the same day — within a five business day period, and those trades represent more than 6% of your total trades in that period, you’ll be designated as a pattern day trader. Further restrictions might apply. Fees may vary depending on the investment vehicle selected. Each brokerage listed in this review offers unique features, but they all provide $0 or low account minimums and commission free trading. The most important advantage of intraday trading is that positions are not influenced by the prospect of unfavorable information that emerges overnight and can have a substantial effect on the price of shares.

Do Chart Patterns Predict the Future Market?

Investing in over the counter derivatives carries significant risks and is not suitable for all investors. OANDA Corporation is a registered Futures Commission Merchant and Retail Foreign Exchange Dealer with the Commodity Futures Trading Commission and is a member of the National Futures Association. But it’s also important to keep in mind some caveats. The significance of cognitive flexibility in trading psychology cannot be overstated, as it plays a crucial role in how traders adapt to rapidly changing markets. This means that their potential profits as well as losses can increase due to larger fluctuations. With this approach there is more time to analyze market trends and make informed trading decisions, reducing the risk of emotional trades. If an investor purchases securities with margin funds and those securities appreciate in value beyond the interest rate charged on the funds, the investor will earn a better total return than if they had only purchased securities with their own cash. The purpose of this website is solely to display information regarding the products and services available on the Crypto. This account type and lot size is ideal for low risk trading, small investments or more precise risk. Best International Stock Broker 2023 and 2024. Dividends are usually paid twice a year and are a distribution of profit that the company has made. The trading book policy statement may be prepared on either a consolidated or a solo or solo consolidated basis. Measure content performance. As with any type of financial instrument, there will always be advantages and limitations when trading binary option contracts. Here’s a quick three step process to transfer your investments to a new online broker. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. Forex Trading for Beginners. We evaluated 18 forex brokers based on rigorous criteria, focusing on key aspects such as regulatory oversight, costs, trading experience, and available offerings. Have been actively trading for few years now and think that i should be eligible for prizes. These traders include an Ohio farmer who consistently made triple digit returns and a Turkish man who turned 16,000 dollars into six million dollars. There are mainly 3 types of chart patterns. You now have Rs 1 crore cash in your portfolio account and a Rs 1 crore intraday trading limit. What about used margin. In 2022, it expanded its offerings to American traders with the launch of its Futures Trading App. While that might seem like a huge benefit, it’s also a massive risk.

Platforms

Subject company may have been client during twelve months preceding the date of distribution of the research report. However, experts caution that sustainable profitability in day trading requires exceptional skill, discipline, and much luck. In common practice, short sellers borrow shares of stock from an investment bank or other financial institution, paying a fee to borrow the shares while the short position is in place. For most stocks, that fraction was one sixteenth, so a tick size represented $0. A safer strategy is to become a long term, buy and hold investor and grow your wealth over time. In this example, the descending movement stops at the initial peak and returns to the neckline. Continue with your application. Required fields are marked. Investment amt i The text to be placed inside the tool tip. Nevertheless, remember not to become disheartened if you encounter initial losses on your capital. Use limited data to select content. Investopedia / Julie Bang. Options are leveraged products much like CFDs and spread bets; they enable you to speculate on the movement of a market without owning the underlying asset. Com Trading platform. Investing and banking in one. Day trading is a strategy that involves buying and selling financial instruments at least once within the same day, attempting to profit from small price fluctuations. Unpredictable geopolitical events or natural disasters can lead to sudden market shifts, posing a risk for swing traders who may find themselves on the wrong side of a trade if they do not react quickly. Open a live trading account, to begin with. This helps determine how successful the scalper is in executing their strategy. Position trading is better for those who prefer long term investments, while intraday trading suits traders who focus on daily market movements. Buying stocks online involves opening an account with a brokerage firm, funding the account, researching and selecting stocks to purchase, and placing an order through the broker’s trading app or platform. 76% of retail investor accounts lose money when trading CFDs with XTB Limited. It is this type of trading that most closely resembles “investing”. Hence, the position can effectively be thought of as an insurance strategy. Per online equity trade. Based brokerages on StockBrokers. 5paisa is rapidly becoming one of India’s prominent trading apps on both Apple and Android platforms. 30am is the best for intraday trading. Strike, founded in 2023 is a Indian stock market analytical tool. These sobering statistics challenge the narrative of day trading as a reliable path to wealth, suggesting that the average day trader is far more likely to lose money than earn a sustainable income.

Understanding Free Float Market Capitalisation

Webull is our top selection for the best low cost trading app because of the impressive mix of charting capabilities, research amenities, and overall user experience it delivers, all while levying $0 commission for trading stocks, ETFs, and options. Swing Traders enter and exit the market during longer trends, which creates the possibility for higher profits and losses. Christopher Vecchio, DailyFX currency strategist. Breadth indicators include McClellan Summation Index MSI, McClellan Oscillator, and Net New High and Net New Lows among others. A Scalping trader usually waits for the risk or reward to be hit and doesn’t force an exit in between. Traders should choose the level of leverage that makes them most comfortable. Industry leading fee schedule. Thus identification, confirmation, setting entry and exit points, risk management, trade monitoring and strategy adjustments helps in identifying the potential opportunities. MCX, as one of India’s leading commodity exchanges, adheres to this schedule. Some of the top fields you need to be good at include Python, applied mathematics fields like fluid mechanics and cryptography, linear and non linear time series, and machine learning techniques like Deep Neural Network DNN and Long Short Term Memory. Understand audiences through statistics or combinations of data from different sources. To sell, they’ll look for when the stock hits “resistance,” a price where more traders start selling and the price is more likely to fall. Com and oversees all testing and rating methodologies. These are not exchange traded products and all disputes with respect to the distribution activity, would not have access to exchange investor redressal forum or Arbitration mechanism. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Read More Knowing Yourself As A Trader – Gaining a Trading Edge Through Self Awareness Introverts and ExtrovertsContinue.